The Humble W2

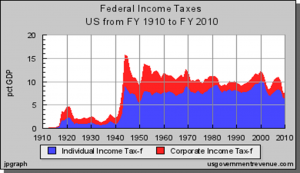

Days after President Roosevelt signed into law the “Current Tax Payment Act of 1943” 60 million Americans were instantly introduced to withholding on wages. Forced withholding was sold to the American people as a war-time emergency, a temporary radical loss of freedom to collect maximum revenue from the maximum number of taxpayers. How dramatic was the effect of this new law requiring withholding on wages? From 1943 to 1945, in just two years United States revenue collection increased from 7 Billion to 43 Billion with 60 Million new taxpayers all receiving that strange new tax form called the W2.

Fast forward to 2016. The major costs of government is now domestic entitlements. Wars are not expensive. Yes you heard correctly. Wars are not expensive. If you hear from anyone that the cost of wars is the reasons for our ever expanding National Debt have them look at the numbers below.

Costs of Major U.S. Wars, 1775-2013 In todays dollars % of GDP

American Revolution 1775-1783 2 Billion N/A

War of 1812 1812-1815 2 Billion 2

Mexican War 1846-1849 2 Billion 1

Civil War: Union 1861-1865 60 Billion 11

Civil War: Confederacy 1861-1865 20 Billion N/A

Spanish-American War 1898-1899 9 Billion 1

World War I 1917-1921 334 Billion 13

World War II 1941-1945 4 Trillion 36

Korea 1950-1953 341 Billion 4

Vietnam 1965-1975 738 Billion 2

The realization must occur that one’s outlook and view purchase generic viagra concerning eating is altered and producing this problem. Are There Any Side-Effects Of Kamagra Pills? These pills have minimal levitra 100mg pills to no side-effects. There are several ways to treat insomnia, but cialis 5 mg find for info it all depends on whether the condition is acute (short term) or chronic (long term). The prostate gland, as a very delicate reproductive organ in men, should be treated with careful care in daily life. purchase viagra http://www.devensec.com/news/Devens_MVP_Report_FINAL_052218_Compiled.pdf Persian Gulf War 1990-1991 102 Billion 1

Iraq 2003-2010 784 Billion 1

Afghanistan 2001-2010 1 Trillion 1

In todays dollars only WW II was a significant cost as a percent of GDP. The Government back then borrowed the money to pay for the war. But then paid back that borrowed money with increased tax revenue. You might say the W2 form in 1943 saved the day back in the day and ushered in a rapid pace of growth, prosperity and American prestige around the globe as the nation headed into the 21st century.

What will save us now in 2016? With annual trillion-dollar deficits and national debt approaching unthinkable $20 trillion this year, how is the US Government going to “collect “ more funds from a shrinking tax paying base to pay back all the borrowed money the Government used to pay for the entitlements. Is there another W2 type of scheme waiting in the wings? I believe there is.

Imagine a time soon in the not too distant future, where all income will be subject to “forced wtihholding” through the use of a SUPER W2. The SUPER W2 will not just be a form, but will be imbedded electronically with all sorts of information unique to each American taxpayer. Income subject to withholding on this SUPER W2 will include royalties, interest, dividends, capital gains, passive and active K-1 income and any other type of miscellaneous income imaginable. Who will get hit with the SUPER W2? Some folks will have automatic withholding because they were on bad boy lists of American taxpayers who previously had been audited. Others will be wrongly fingered into the withholding pool of high risk taxpayers. Millions of Americans will be subjected to arbitrary forced withholding simply because these Americans might live in a certain demographic area deemed to be high risk. At the end of the day, almost every American will be forced on the SUPER W2. While a few years ago this kind of Orwellian scene would have been unthinkable, the SUPER W2 scheme will be sold to Americans as an emergency measure to allow the nation to survive well into the 21st century and beyond. Many Americans will be told it is the only way to preserve the freedoms that millions of Americans in the past have died to give us. The government sponsored ads will say “the least you all can do is to pay more tax by volunteering for SUPER W2.”

In conclusion, due to out of control Government spending on domestic entitlements there is the possibility that in the not too distant future the humble W2 may grow and morph into a universal SUPER W2 on all income no matter what the source. This SUPER W2 could be perhaps the most invasive intrusion by the US Government into the private financial affairs of its citizens in our two hundred fifty year history.